Financial health simply measures your ability to handle financial stressors and reach your long-term goals. The areas of financial health typically considered are:

- Savings and debt paydown: Are you able to cover your needs, your wants and still have enough to build savings and pay down debt over time? The 50/30/20 budget is a good measure.

- Debt-to-income ratio: This comparison of your monthly debt payments to your monthly gross income gives you a good idea of how manageable your debt load is. It’s also a common measure used by creditors in making approval decisions.

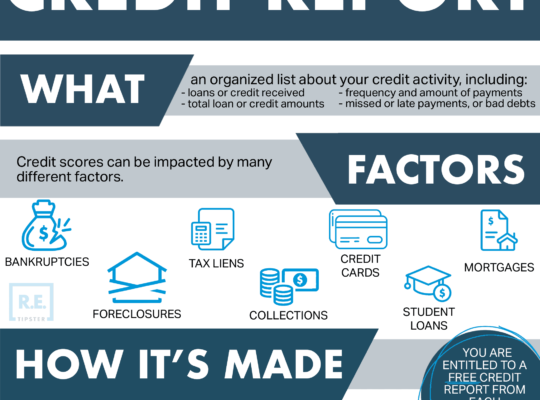

- Credit score: Even if you don’t plan to apply for more credit, a good or excellent score can play a role in things like apartment applications, insurance costs, utility deposits and more.

- Emergency fund: Having enough in the bank to weather financial shocks protects you from debt spirals and the credit score damage that comes from missing bill payments.

- Insurance: This protects assets — such as vehicles, personal possessions and your home — and it also protects dependents in case you’re unable to work.

- Financial planning: Staying financially healthy means saving toward retirement, working on estate planning and more

The investing information provided on this page is for educational purposes only. Money Mentor, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.