More articles about credit

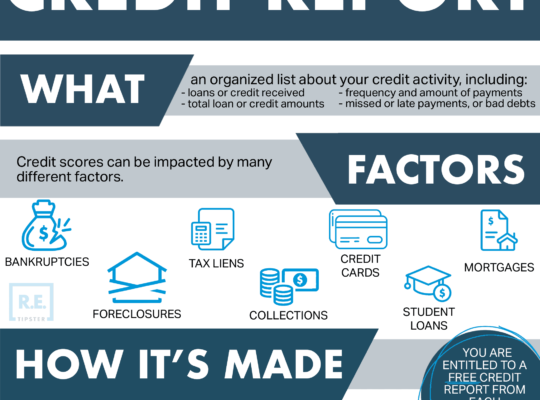

Credit scores can feel like one of the most confusing parts of adulting. They affect your ability to rent an apartment, get a credit card, buy a car, or even land a job — but most of us were never taught how they actually work.

The truth? While everyone’s credit situation is unique, credit scores are generally based on five key factors. Understanding these factors can help you take control of your score, avoid costly mistakes, and build long-term financial confidence.

Let’s break them down 👇

1. Debt-to-Credit Utilization

What it is:

This is how much credit you’re currently using compared to the total credit available to you.

Why it matters:

High utilization can signal to lenders that you’re overextended and might have trouble repaying what you owe. Keeping your utilization under 30% is a good general rule — lower is even better.

Example:

If your credit card has a $1,000 limit, try to keep your balance below $300.

2. Credit Mix and Experience

What it is:

This refers to the different types of credit accounts you have, such as:

- Credit cards

- Student loans

- Car loans

- Mortgages or installment loans

Why it matters:

A healthy mix shows lenders that you can manage different types of credit responsibly over time.

Pro Tip:

You don’t need every type of loan — but having more than just one credit card can help build a stronger profile.

3. Payment History

What it is:

This is your track record of making payments on time.

Why it matters:

Your payment history is the most important factor in your credit score — even one late payment can hurt your score and stay on your report for years.

Tip:

Set up autopay or reminders to ensure you never miss a due date.

4. Credit History Length

What it is:

How long your credit accounts have been open.

Why it matters:

Lenders like to see long-term, stable use of credit. The older your accounts, the more positive history you’ve built up.

Pro Tip:

Even if you no longer use your first credit card, consider keeping it open — that account’s age is helping your score.

5. New Credit and Inquiries

What it is:

This includes recently opened credit accounts and the number of “hard inquiries” — checks done by lenders when you apply for new credit.

Why it matters:

Too many new accounts or inquiries in a short time can signal risk to lenders and lower your score temporarily.

Tip:

Only apply for new credit when necessary. Spacing out applications can help minimize the impact.

TL;DR – What Makes Up Your Credit Score?

Here’s a quick recap of what matters most:

| Factor | What to Aim For |

|---|---|

| Debt-to-Credit Ratio | Use <30% of your available credit |

| Credit Mix | A healthy mix of loans and cards |

| Payment History | Always pay on time |

| Credit History Length | Keep older accounts open |

| New Credit | Limit new credit applications |

Final Thoughts

Credit scores don’t have to be scary — and you don’t need to be a financial expert to improve yours. Start with the basics: pay on time, borrow responsibly, and avoid maxing out your cards.

Over time, those habits build a solid credit profile that opens doors to better interest rates, easier approvals, and greater financial freedom.

Need help getting started?

Many fintech platforms offer free credit monitoring, budgeting tools, and personalized tips to help you track your score and make smarter financial choices.

Have questions or want to share your credit-building journey? Drop a comment below or subscribe to our newsletter for more bite-sized money tips.