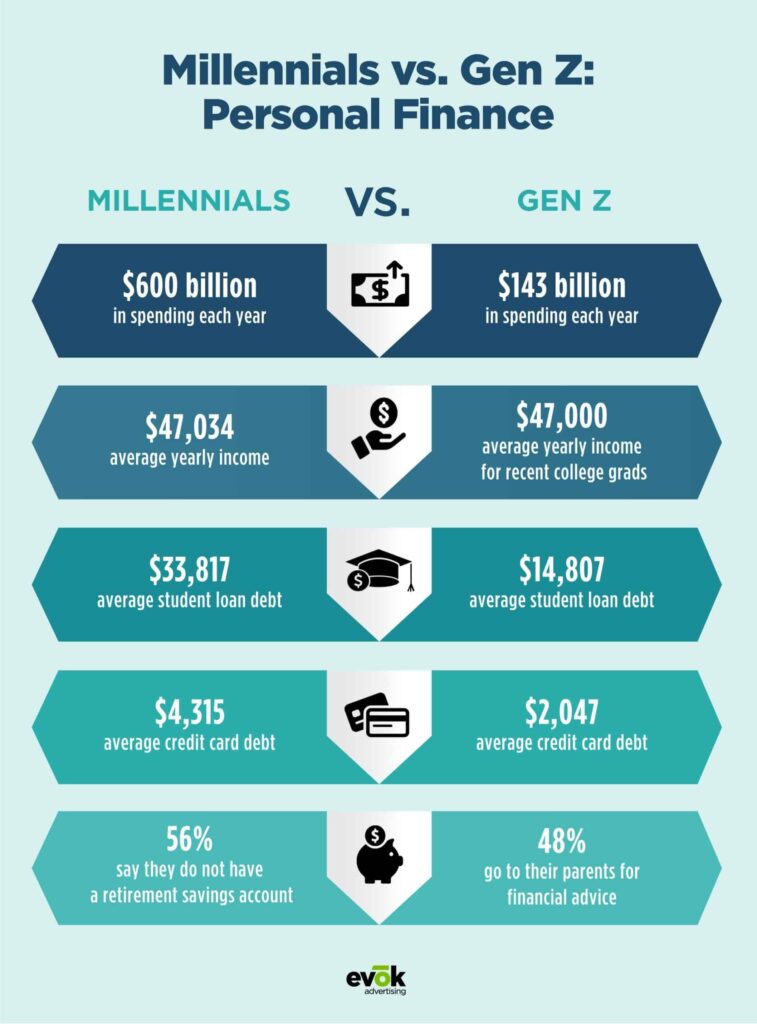

In today’s fast-paced, digitally driven world, managing your money wisely isn’t just smart—it’s essential. Whether you’re a Gen Z college student juggling part-time gigs or a millennial navigating career growth and rising living costs, personal finance can feel overwhelming. But it doesn’t have to be. With the right mindset and a few key strategies, you can take control of your financial future.

1. Know Where Your Money Goes

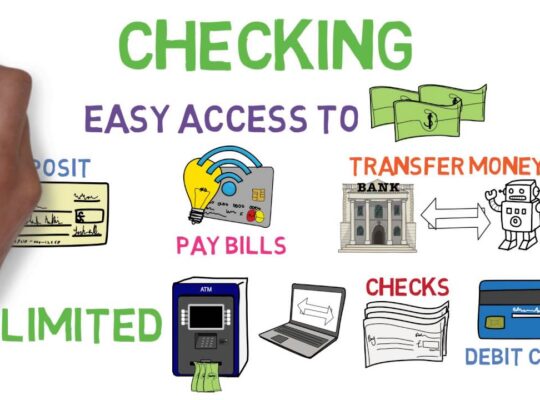

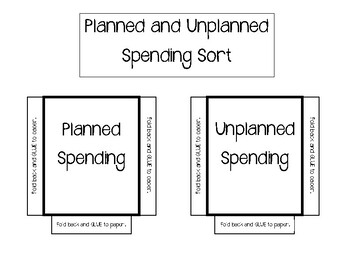

It all starts with awareness. Track your income and expenses for a month. Use budgeting apps like Mint, YNAB (You Need a Budget), or even a simple spreadsheet. Categorize your spending—rent, food, subscriptions, entertainment, savings—and identify where you can cut back.

Pro tip: If you’re spending more on Uber Eats than groceries, it might be time to rethink your habits.

2. Build an Emergency Fund

Life happens. Cars break down, laptops crash, jobs change. An emergency fund is your buffer against the unexpected. Aim to save at least 3–6 months’ worth of living expenses in a separate, easily accessible account.

Start small. Even saving $10 a week adds up. The key is consistency.

3. Kill High-Interest Debt First

Student loans are daunting, but credit card debt is often worse due to high interest rates. Pay off high-interest debt aggressively while making minimum payments on lower-interest loans.

Debt snowball or avalanche? Both strategies work—pick the one that motivates you and stick to it.

4. Start Investing Early

Time is your greatest asset. Thanks to compound interest, the earlier you invest, the more you’ll earn in the long run. You don’t need to be rich to start—apps like Acorns, Robinhood, and Fidelity make investing accessible with as little as $5.

Focus on low-cost index funds or ETFs if you’re just getting started. And always invest with a long-term mindset.

5. Live Below Your Means (Even When You Get a Raise)

It’s tempting to upgrade your lifestyle with every pay bump. But financial freedom often comes from living like you earn less than you actually do. Save and invest the difference. Future you will be grateful.

6. Educate Yourself

Podcasts like The Financial Confessions or BiggerPockets Money, books like The Psychology of Money by Morgan Housel, and YouTube channels like Graham Stephan or Her First 100K can help you grow your financial IQ.

Knowledge is power—and it’s free.

7. Plan for the Long Term

Retirement feels far away, but starting now gives you a massive head start. Open a Roth IRA or contribute to your employer’s 401(k), especially if there’s a match (that’s free money!).

Also, think about financial goals: buying a home, starting a business, traveling. Write them down and build your finances around them.

Final Thoughts

You don’t need to have it all figured out today—but you do need to start. Financial wellness is a journey, and the earlier you take the first step, the better your future will look.

Stay curious, stay consistent, and remember: you’re investing not just in your wallet, but in your freedom.