Starting college is exciting — new friends, new freedoms, and a brand-new environment. But one thing often overlooked in the rush of move-ins and class schedules? Money.

If you’re a freshman, managing your finances might feel overwhelming. But don’t worry — it doesn’t have to be complicated. This guide breaks down the essentials of personal finance in a way that actually makes sense (and doesn’t make your eyes glaze over).

Why Personal Finance Matters in College

College isn’t just about academics — it’s a crash course in real-life adulting. For many students, this is the first time managing their own money. Rent, textbooks, late-night pizza orders — it adds up quickly.

Learning to manage your finances early on isn’t just smart, it’s empowering. It sets you up for financial independence, builds good habits, and reduces stress (which you’ll need during finals week).

The Big Three: Budget, Save, Spend Wisely

Whether you have a part-time job or rely on student loans and allowance, here’s the personal finance “starter pack” every college freshman should know:

1. Budget

Know what’s coming in and what’s going out. Track your income and expenses monthly. If your expenses are more than your income — red flag 🚩.

2. Save

Even saving $10 a week builds a cushion over time. Set up a savings account and treat saving like paying a bill — non-negotiable.

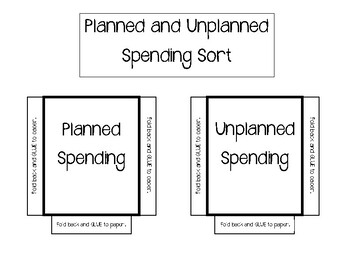

3. Spend Smart

Take advantage of student discounts, thrift shops, and free campus events. Ask yourself: "Do I really need to order food again this week?"

Build a Simple Budget (Without the Headache)

No need to be an Excel wizard. A budget is simply a roadmap for your money. Here’s a simple way to start:

- Income: Scholarships, part-time jobs, parental support, etc.

- Fixed Expenses: Rent, tuition, phone bill.

- Variable Expenses: Food, entertainment, transportation, subscriptions.

Use a free budgeting app like Mint, YNAB, or even a basic Google Sheet. Automate where you can.

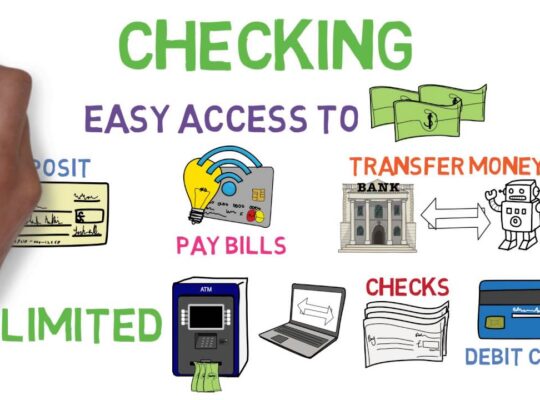

Banking 101: Choosing the Right Account

Look for student-friendly banks that offer:

- No monthly maintenance fees

- Free ATM access

- Mobile app access

- Easy-to-use savings options

Some fintech platforms even allow budgeting, savings goals, and spending tracking all in one app — perfect for beginners.

Set Financial Goals — Big and Small

Whether it’s saving up for spring break, a new laptop, or graduating debt-free, having goals gives your money direction. Break it down:

- Short-Term: Save $200 for holiday travel

- Mid-Term: Build a $500 emergency fund

- Long-Term: Limit student loan debt by sticking to a budget

Avoid These Common Freshman Financial Pitfalls

We’ve all been there. But you can learn from the mistakes of others. Watch out for:

🚫 Eating out daily

🚫 Opening store credit cards just for a discount

🚫 Paying full price for textbooks (check used or rental options!)

🚫 Forgetting to cancel free trials and subscriptions

One click can cost you $10/month for a service you never use.

Your Money = Your Freedom

At the end of the day, money isn’t just about numbers — it’s about options. When you manage your finances, you give yourself the freedom to say yes to the things that matter and no to the things that don’t.

Quick Checklist to Get Started:

✅ Track your income and expenses

✅ Create a simple budget

✅ Start saving something — anything

✅ Spend with purpose

✅ Avoid common traps

✅ Set personal financial goals

Bottom line: You don’t need a finance degree to master the basics. Start small, stay consistent, and don’t be afraid to make mistakes — every smart financial move now is one less regret later.

Want more tips on student budgeting, saving, and fintech tools designed for you? Subscribe to our newsletter and get smarter with money, one week at a time.