Conquer Financial Anxiety with These Tips!

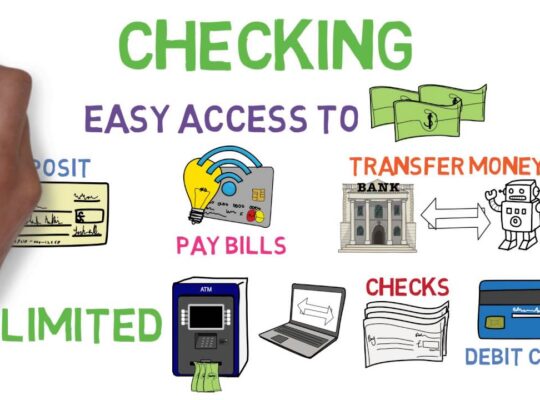

To conquer financial anxiety, create a budget, build an emergency fund, manage debt, practice mindfulness, and prioritize self-care. Here’s a more detailed breakdown of tips to help you manage financial anxiety: 1. Take Control of Your Finances: 2. Practice Financial Mindfulness: 3. Prioritize Self-Care: