Managing your personal finances may seem overwhelming at first, but it all starts with forming good habits and building a solid foundation. Whether you’re starting your first job, moving out on your own, or just want to take control of your money, here are the top 10 personal finance tips for beginners to help you get started on the right foot.

1. Earn What You Deserve, and Spend Less Than What You’re Paid

The first step to financial wellness is making sure you’re earning a fair wage for your work. Research your industry standards and don’t be afraid to negotiate your salary. Once you’re earning a proper income, the golden rule is simple but powerful: spend less than you earn. This creates room for savings, investment, and future security.

2. Track What You Spend

You can’t manage what you don’t measure. Start by tracking every dollar that comes in and goes out. Use apps like Mint, YNAB (You Need A Budget), or a simple spreadsheet to categorize your expenses. When you see where your money is actually going, you’ll be surprised at how much easier it is to cut back on unnecessary spending.

3. Pay Off Your Credit Card Debt

Credit card debt is one of the biggest financial traps. With high interest rates, it can quickly spiral out of control. Make it a top priority to pay off your balance in full every month, and avoid using credit cards for purchases you can’t immediately afford. Carrying a balance can cost you hundreds or even thousands over time.

4. You Must Have a Savings Plan

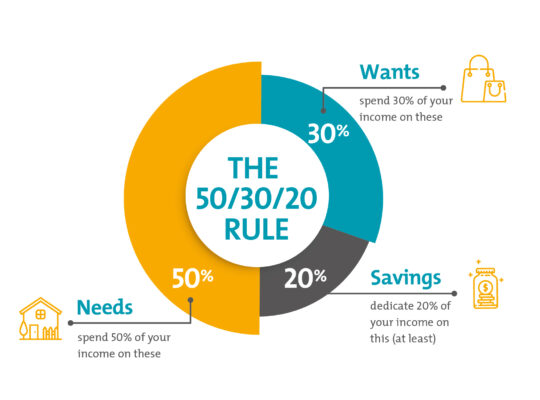

Saving money isn’t something that happens by accident—it requires a plan. Set a percentage of your income (even just 10%) to automatically go into savings. This “pay yourself first” approach ensures you’re prioritizing your future, not just your present.

5. Set Small, Achievable Goals

Big financial goals can feel intimidating. Break them down into small, actionable steps. Want to save $1,000? Start with $50 a week. Want to pay off debt? Begin by tackling the smallest balance. Small wins build momentum, and momentum builds confidence.

6. Set Aside Money for an Emergency Fund

Life happens—job loss, car repairs, medical bills. That’s why an emergency fund is crucial. Aim to save at least 3 to 6 months’ worth of living expenses in a separate, easily accessible account. This fund can prevent you from going into debt when the unexpected arises.

7. Don’t Co-sign a Loan

It may seem like a kind gesture to help someone out by co-signing, but it comes with huge risks. If the borrower misses payments, you’re on the hook—and your credit score could take a hit. Protect your financial future by politely declining to co-sign loans.

8. Go Digital

Take advantage of the many digital tools designed to simplify your finances. Budgeting apps, online savings accounts, investment platforms, and digital wallets can all help you stay organized and in control. Automation is your best friend—use it to pay bills, save, and invest consistently.

9. Learn the Basics of Investing

You don’t need to be a Wall Street expert to start investing. Learn about basic concepts like compound interest, index funds, and retirement accounts. Starting early gives your money more time to grow. Even small, regular contributions to a 401(k) or Roth IRA can make a big difference over the long term.

10. Educate Yourself Continuously

The world of personal finance is always evolving, and staying informed is key. Read books, follow finance blogs or YouTube channels, and consider talking to a financial advisor. The more you learn, the better decisions you’ll make. Financial literacy is a lifelong skill.

Final Thoughts

Getting your personal finances in order doesn’t happen overnight, but taking small, consistent steps will get you there. Start with these 10 tips, and remember: the goal isn’t perfection—it’s progress. The sooner you begin, the better off your future self will be.